Not known Factual Statements About Fortitude Financial Group

Not known Factual Statements About Fortitude Financial Group

Blog Article

A Biased View of Fortitude Financial Group

Table of ContentsWhat Does Fortitude Financial Group Do?Getting The Fortitude Financial Group To WorkThe Only Guide for Fortitude Financial GroupWhat Does Fortitude Financial Group Mean?

With the right plan in area, your cash can go even more to aid the companies whose missions are straightened with your worths. An economic advisor can aid you specify your charitable providing objectives and include them right into your economic strategy. They can additionally advise you in ideal methods to optimize your giving and tax deductions.If your service is a collaboration, you will want to go through the sequence preparation procedure with each other - St. Petersburg, FL, Financial Advising Service. A financial expert can help you and your companions recognize the crucial elements in organization sequence planning, establish the worth of business, produce investor contracts, establish a payment framework for followers, rundown transition options, and a lot more

The key is finding the right financial expert for your scenario; you might end up interesting different experts at various stages of your life. Try calling your economic establishment for suggestions.

Your following action is to talk with a qualified, accredited professional who can give guidance customized to your specific situations. Nothing in this short article, nor in any kind of associated resources, ought to be taken as economic or lawful recommendations. While we have actually made excellent confidence initiatives to ensure that the info offered was appropriate as of the date the material was prepared, we are unable to assure that it continues to be accurate today.

Fortitude Financial Group Can Be Fun For Everyone

Financial consultants help you choose concerning what to do with your cash. They direct their customers on conserving for major purchases, putting money apart for retired life, and spending cash for the future. They can also advise on current economic and market task. Let's take a closer look at exactly what a monetary consultant does.

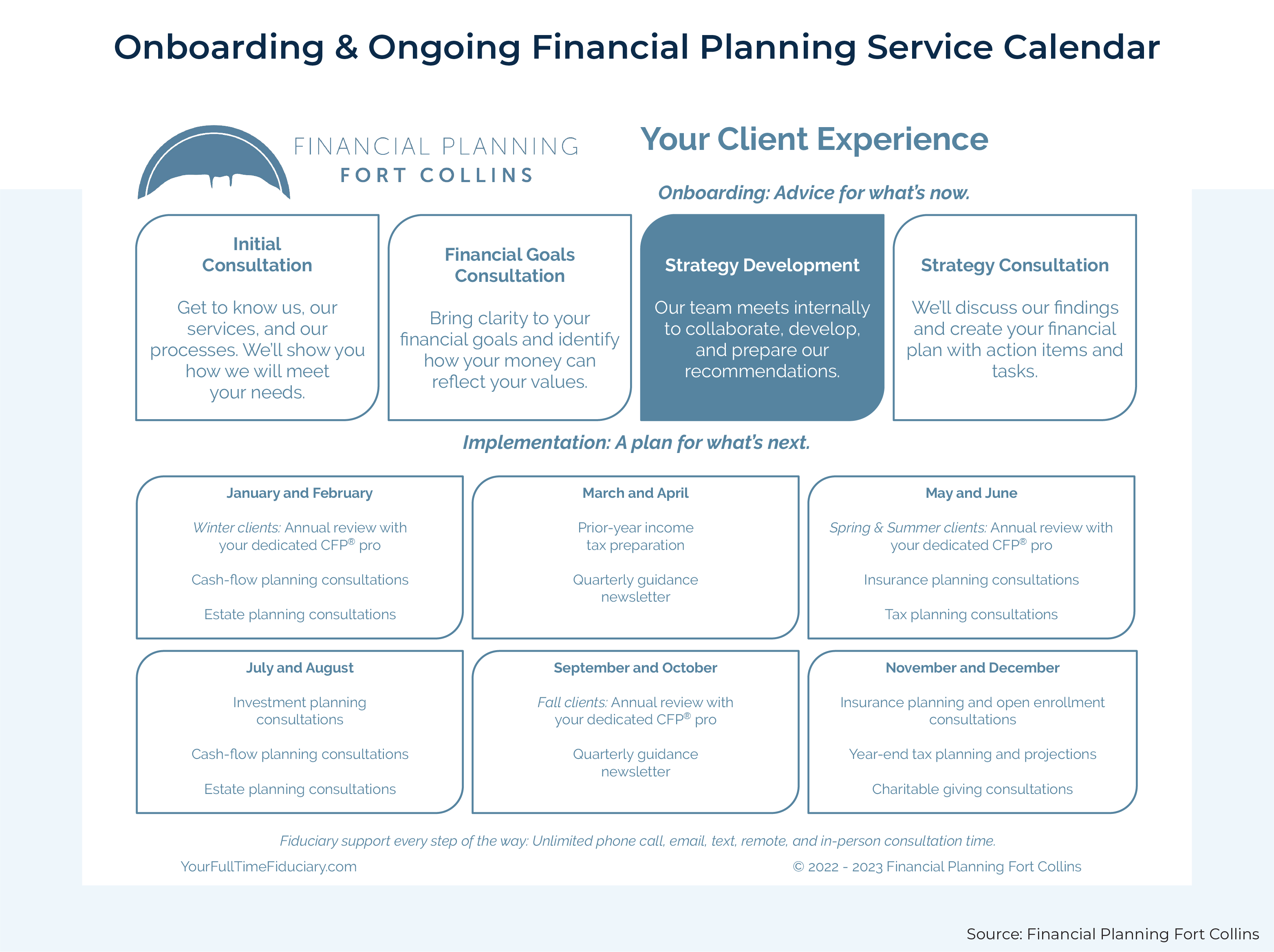

Advisors utilize their knowledge and experience to construct personalized financial strategies that aim to attain the monetary objectives of clients (https://triberr.com/fortitudefg1). These plans consist of not only investments but additionally cost savings, budget, insurance coverage, and tax obligation methods. Advisors better sign in with their customers regularly to re-evaluate their present situation and plan appropriately

Examine This Report about Fortitude Financial Group

Allow's say you wish to retire in twenty years or send your child to an exclusive university in 10 years. To complete your objectives, you might require a knowledgeable specialist with the best licenses to aid make these plans a truth; this is where a financial consultant can be found in (St. Petersburg, FL, Financial Advising Service). Together, you and your consultant will cover lots of subjects, consisting of the amount of cash you must conserve, the kinds of accounts you need, the sort of insurance policy you must have (including long-lasting treatment, term life, impairment, and so on), and estate and tax preparation.

Financial consultants provide a variety of solutions to customers, whether that's giving reliable general financial investment suggestions or helping within an economic goal like buying an university education fund. Listed below, find a list of one of the most common solutions provided by financial advisors.: A monetary consultant offers guidance on financial investments that fit your design, objectives, and risk resistance, creating and adapting spending technique as needed.: A financial expert produces approaches to aid you pay your debt and stay clear of debt in the future.: An economic consultant gives tips and approaches to develop budgets that help you satisfy your objectives in the brief and the lengthy term.: Part of a budgeting strategy might include strategies that help you pay for higher education.: Furthermore, a financial consultant creates a conserving plan crafted to your certain requirements as you head into retirement. https://penzu.com/p/955661562c60f973.: A monetary expert aids you recognize individuals or companies you wish to receive your tradition after you pass away and develops a plan to perform your wishes.: An economic advisor offers you with the very best long-lasting remedies and insurance policy choices that fit your budget.: When it pertains to tax obligations, a financial advisor may assist you prepare tax obligation returns, maximize tax reductions so you obtain one of the most out of the system, timetable tax-loss collecting safety sales, make sure the ideal use the funding gains tax rates, or plan to decrease tax obligations in retired life

On the survey, you will also show future pensions and revenue resources, task retirement needs, and define any kind of lasting monetary obligations. In other words, you'll note all existing and anticipated financial investments, pensions, presents, and income sources. The investing part of the survey touches upon even more subjective topics, such as your risk resistance and danger capacity.

The smart Trick of Fortitude Financial Group That Nobody is Talking About

At this moment, you'll also allow your advisor understand your investment preferences too. The initial evaluation might also consist of an evaluation of other monetary monitoring topics, such as insurance coverage issues and your tax scenario. The advisor needs to be mindful of your current estate plan, along with other i loved this experts on your preparation group, such as accountants and attorneys.

Report this page